by Ken Mowry and Ed Scott

New Opportunities and New Challenges for Multi-Brand Retailers

Digital commerce is at an inflection point. For private equity firms and search funds that have acquired multi-brand retail holdings – physical, digital-only or some combination of these – the pandemic has created unique opportunities to rapidly expand online sales and accelerate EBITDA growth.

Pandemic overhang is creating a lasting impact on consumer sentiment, online shopping, brand loyalty and the appeal of Ecommerce across demographics. This confluence of Ecommerce trends will largely benefit retailers well-positioned to broaden strategic engagement with digital consumers and quickly shift technology investments to serve them. Speed and adaptability always separate winners from losers in the digital space.

To capitalize on these opportunities, retailers will need to accelerate development of digital capabilities. If Financial Sponsors hope to benefit from this new earnings uplift in advance of an exit, now is the time for them to re-evaluate the digital strategy, technical infrastructure and operational capabilities of their retail portfolio companies.

Trend 1: Ecommerce Eats Retail For Lunch

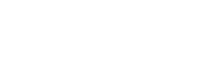

It is no surprise that Ecommerce sales exploded during the pandemic. Ten years of growth occurred in just three months in 2020, with sales jumping 32%. What surprised many, however, was the total volume of online sales given the extent of our economic crisis.

The shift to online shopping in essential categories like groceries and home goods was obvious. The strength of discretionary categories like consumer electronics and home furnishings was not.

Despite a dip in sales growth as predicted for 2021, Ecommerce penetration is now picking up steam again. Over the next few years, eMarketer predicts Ecommerce will have grown from about 14% in 2018 to nearly 20% of all retail sales in 2024.

As the convenience and desirability of in-store shopping wanes, more stores will close. UBS predicts 80,000 locations (or 9% of current store count) will shut their doors over the next 5 years. In turn, this will drive more consumers to shop online for the first time or shop in new categories such as groceries, health and home essentials.

Increases in online users and frequency of online purchases will have a permanent impact on the retail industry. Digital channels will no longer be a complement to a Retailer’s in-store sales. They will be its lifeline. Retailers that understand how to create and continually evolve world-class digital experiences will come out on top and remain competitive.

Trend 2: The Rise of Disloyal Customers

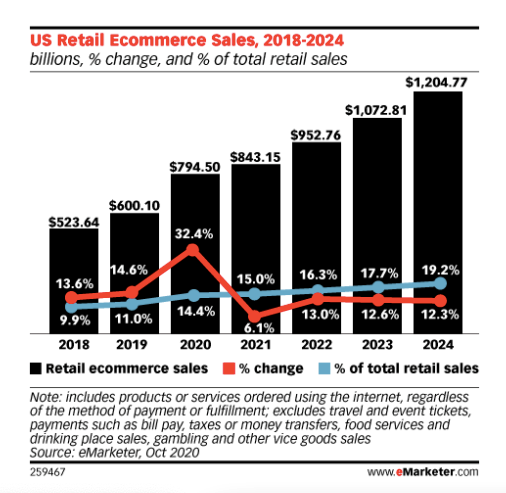

According to a consumer sentiment report by McKinsey, an astonishing 75% of US consumers have tried new shopping behaviors and 36% have tried new product brands over the past year and a half. On average, 75% of these consumers intend to continue these behaviors beyond the crisis.

Source: McKinsey & Company: The Great Consumer Shift: Ten Charts That Show How US Shopping Behavior is Changing.

More than ever, consumers are willing to try new retailers and new brands, quickly and with little effort online. In the McKinsey study, the main reasons cited by consumers for this switch in allegiance was availability, convenience, value and quality. Facilitated returns adds fuel to the fire.

“If you’re waiting for this to end, you say we’re gonna be back to normal in (a few) months, that we’re just biding our time and getting through it, then you’re gonna be screwed.” – Jill Manoff, Editor in Chief, Glossy in The Future of Ecommerce Report 2021

In a world where digital data, social opinion and alternative sources for products are a click away, Retailers have added pressure to attract and retain digital customers. Worse, behavioral changes are not linear.

Consumer engagement now depends on satisfaction across the entire Retail journey. For both established and new brands, this is not a winner-takes-all war driven by marketing. It is an ongoing battle fought on the basis of evolving customer experiences.

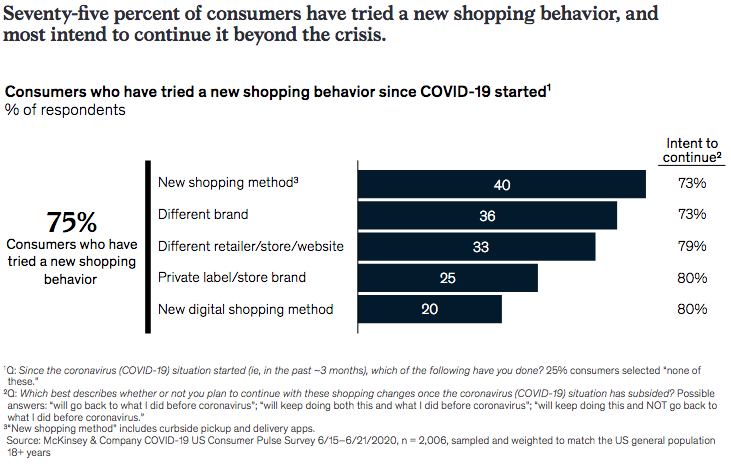

Trend 3: Broadening Digital Demographics

It was not just the digitally affluent Gen Z and Millennials that embraced these changes in loyalty and purchasing patterns. Gen X and Boomers also made significant shifts during the pandemic. This included retirees who quickly adjusted shopping behavior to mimic younger segments. A global survey by Shopify indicated 84% of all consumers shopped online during the pandemic.

Source: Insider Intelligence, eMarketer, CouponFollow

“When I think back on consumer life this past year, it’s nothing short of amazing to have gotten so many older people online. This is a complete cohort – some of whom had been on the sidelines of the digital world – that is now very adept at online shopping, exercise classes and video calls.” -Henry Pollock, Senior Business Analyst, McKinsey & Company

Ironically, even as loyalty to retailers has become porous, building a brand has never been more important. That’s because most product searches are unbranded. Companies are loath to cede customer relationships and data to retail marketplaces, requiring them to drive visibility through adept marketing, engagement and branding.

Meantime, consumers are rewarding organizations that humanize the buying journey. They’re also favoring brands that support societal causes. For retailers, brands are requisite beacons in a sea of consumer options.

To succeed in this environment, retailers must segment and personalize their brands across broader demographics while clearly messaging the brand’s social value. To drive incremental profits, retailers must also find ways to get greater value from acquired customers.

Given the lower relative costs of Ecommerce, digital sales are especially important to this topline growth and, as the breadth of Ecommerce penetration continues, digital customers only grow in importance.

Opportunity: Creating the Retail “Digital Halo Effect”

In the face of these trends, we are seeing tremendous opportunities for multi-brand retailers to make brand portfolios more profitable through what we call the “Digital Halo Effect”. The goal is to maximize engagement of each online visitor by exposing them to a related portfolio of brands and driving transactions through predictable customer experiences.

For example, we worked with one retailer to create a shared online checkout platform across a portfolio of their brands. The result was a 30% increase in sales by and 50% reduction of website abandonment to competitors within 18 months. A core element of the engagement was using customer data to understand the contextual value of related brands, opportunities to expose digital customers to related brands and the elements that drove transactions across brands.

The “Digital Halo Effect” is especially valuable at a time when so many consumers are willing to try new digital brands and shopping experiences. By structuring an online brand platform, retailers create a walled-off virtual garden which can tailor and target unique messaging within and across brands. This not only engages new customers but can dramatically increase the lifetime value of existing customers by 3x to 5x. The cost of creating these brand platforms is almost marginal in relation to associated returns.

Opportunity: Filling the Gap with Digital-Only Brands

Once a virtual brand marketplace has been established, retailers can use the platform to identify adjunct digital-only brands that fill gaps among current customers and leverage an established customer base to launch these brands.

This business model allows retailers to exponentially expand their market by capitalizing on customer segmentation data, targeting factors, response rates and cross-brand sales to pinpoint acquisition targets or new potential product launches. The approach further provides a rapid and cost-effective approach to field-test concepts and incubate brands. Among the categories that offer substantial halo-effect and digital-only brand opportunities are apparel brands, sporting goods, outdoor brands, consumer wellness products and food.

As an example, for one portfolio of brands, we developed an agile approach that harnessed customer data, website traffic, market and competitor information to surface an evolving set of brand growth opportunities. The work resulted in our developing and piloting a new digital-only brand. In advance of launch, the management team was able to test concepts, validate the idea and refine the approach. They also leveraged the infrastructure of sister brands to scale development and advertising investments with measured confidence and a high return on invested capital (ROIC). The brand went on to witness explosive growth in its first two quarters after launch.

Another public example of this approach can be seen at Gap Inc.. After consolidating its Gap, Old Navy and Banana Republic brands into an online brand platform, the company generated a huge boost in sales by facilitating cross-channel web traffic. Gap then identified “athleisure” as a relevant opportunity and acquired the Athleta, at the time a digital-only brand. Following an incubation period in its online marketplace, Athleta launched physical stores for the brand. It is now the fastest growing brand in the Gap portfolio.

Opportunity: Converting Manufacturers into Direct-to-Consumer Retailers

For certain product manufacturers, launching a virtual marketplace for related brands is a savvy way to launch or expand their direct-to-consumer business. The online platform can also become the centerpiece of a related digital acquisition rollup strategy.

Manufacturers predominantly focus on white-labeled product sales or retail distribution models. Sometimes it is both. And while it may not be in the DNA of manufacturing companies to make strategic investments in direct-to-consumer virtual marketplaces, these platforms can drive new sources of revenue without affecting retail channels, increasing operating margins by 1.5X to 2X. This source of advantage becomes crucial in highly competitive and digitally driven markets.

“By 2022, organizations using multiple go-to-market approaches for digital commerce will outperform (other) organizations by 30 percentage points in sales growth.” – Gartner Research & Advisory

For both Manufacturers and Retailers, investment in virtual marketplaces and digital-only brands also makes digital ad spending more efficient within and across brands. In the current market, optimizing ad spend is becoming a critical necessity more than a luxury.

A study by eMarketer showed that between 2016 and 2020, digital ad spending in the US doubled to $33 Billion and is expected to rise another 25% by 2022. Some of this increase is related to soaring customer acquisition costs and it’s easy to see why. According to Shopify, the cost per click for Facebook went from $0.71 in January 2020 to $1.00 in July 2020, a 41% jump that has remained high. The cost to acquire new customers is now more than $30 on branded marketplaces.

As the volume of digital advertising grows and brands continue to jostle for position on platforms like Google, Facebook and Amazon, unit costs and acquisition costs will continue to climb. Under these circumstances, a direct-to-consumer play for manufacturers can become a key strategic element in strengthening operating margins.

Enlisting The Right Partners to Drive Digital Growth

Ecommerce as a percentage of total retail sales will continue to grow. This trend is a tailwind for digital brands. It’s also a headwind for retailers unprepared in a crowded and competitive Ecommerce world.

The challenge for many private equity firms and search funds with retail holdings is that portfolio company management teams frequently lack the digital know-how, expertise or technical skills required to identify, implement and operate new Ecommerce opportunities. Even as portfolio companies identify gaps in their capabilities and build teams fit for purpose, the market continues to evolve.

To accelerate digital growth requires partners that have worked through the complexity and fluidity of digital transformations and who understand the timing and constraints of equity financing. In addition to support provided by private equity and search fund operating partners, portfolio companies require breadth, depth and elasticity of digital expertise to help them deliver on an Ecommerce roadmap.

Processes and technology are as important as people. Portfolio companies need agile methodologies that help prioritized opportunities and focus entirely on execution. They also require a dynamic approach to shifting technology and infrastructure investments towards high-value areas such as multi-brand platforms, digital-only brands, hybrid rollup strategies and new direct-to-consumer offerings.

Getting Results

New Revolution Partners is an advisory firm that works with private equity and search fund portfolio companies to ignite digital growth. We understand the challenges of the private capital investment cycle and drive accelerated value capture in portfolio companies by focusing on execution, not just strategy. We engage our clients through short-duration efforts, not long-duration projects. Our sprint-driven agile methodology identifies and prioritizes growth opportunities, then builds processes to execute and deliver tangible results, embedding these in our client teams.

To find out how New Revolution Partners can help accelerate your digital growth initiatives, contact us for more information or schedule an opportunity assessment call with our partners. info@newrevolutionpartners.com (415) 598-8484

New Revolution Partners was created to help portfolio companies accelerate value creation and complement the operational strengths of Financial Sponsors. NRP is comprised of Senior Executives with deep digital strategy, operations and transformation experience.

About the Authors:

Ken Mowry is a Managing Director with New Revolution Partners who has been unlocking shareholder value for more than two decades through complex omni-channel and direct-to-consumer go-to-market retail digital transformation programs in both large-scale organizations and smaller, private equity owned companies. His experience spans a wide range of the retail sectors, including specialty outdoor, apparel and hard goods.

Edward Scott is a Founder and Managing Director with New Revolution Partners who has spent three decades as a senior executive and consultant to startups and Fortune 1000 companies. He has spent his career leading business transformation programs that focus on accelerating revenue growth and cost efficiencies by leveraging digital capabilities to drive product, service and customer differentiation. His experience spans a range of strategy, design and technology disciplines across industries, including Retail, CPG, Consumer Tech and Financial Services.